March 16, 2023

Payment industry players: delegate your non-differentiating products to a Core Banking Platform ⚡

In an ever-changing payment market, financial players face...

New technologies, new products, new distribution channels... The financial ecosystem constantly looks to the future for banking experiences and products adapted to new practices.

Consumers expect financial institutions to provide increasingly personalized advice, while GAFAMs and other Big Techs multiply their offensives in the banking sector. Financial players must therefore succeed in accelerating innovation to seduce customers while counterattacking against this new kind of competition.

Fortunately, they can count on a new generation of Core Banking in this frantic race... Explanations!

Process Oriented Core Banking (POBC), or Core Banking Platforms, represents the latest generation of core banking solutions. Developed over the last few years, they offer financial institutions the opportunity to take full advantage of the digital revolution by meeting the scalability needs of the industry.

CBP is based on an open, flexible, and modular architecture and enables the creation of efficient ecosystems capable of fluidizing interactions between financial services and Tech players while offering increasingly personalized customer experiences with an accelerated Time to Market.

Thanks to their lean code, Core Banking Platforms can manage complex products and processes directly in the cloud. They can be deployed continuously, without interruption, with meager maintenance costs and perfect scalability. CBPs are particularly well suited to the challenges of Open Banking and "Best-of-Breed" approaches.

Companies like Skaleet deliver these new Core Banking solutions by leveraging new technology precepts to manage digital experiences, operations, and ecosystems agilely. This is a great way to accelerate innovation, whether you are a bank, a neobank, a credit institution, or even an Embedded Finance player!

Read also: Core Banking —a fourth-generation based on platformisation 👨💻

Despite significant technology growth, banks still rely on Core Banking Systems, and legacy technologies not designed to meet new customer needs. The main problem for banks is the lack of scalability of their IT systems, which prevents them from providing personalized experiences due to the complexity and rigidity of technical architectures, exacerbated by new regulatory requirements.

Also read: Components and microservices give banks flexibility⚡️

For example, according to an Accenture survey on banking operations, 80% of top bank executives fear their organization will be at risk if their technology is not upgraded to be more flexible and able to support rapid innovation.

The Boston Consulting Group estimates that banks risk putting 15 to 25 percent of their revenue at risk if they don't improve their daily banking offerings by incorporating new features, providing an innovative customer experience, and using data better.

Neo-bank users are inactive partly because of the limited product catalog. Indeed, since most neo-banks are not licensed as credit institutions, the services are more limited: no checkbook, no authorized overdraft, and no credit or savings offer...

In a study of French neobanks, the ACPR found that almost all of their banking revenues come from only 20% of their customers. This reality weighs on their profitability. Also, in 2019, each customer generated a median loss of 20 euros for neobanks. This situation is not unique to France since the firm Business Insider Intelligence estimated that this amount was 11 dollars per user worldwide. An untenable position in the long run...

Also read: Why do neobanks have to reinvent themselves? 🤔

To remain profitable in this environment, neobanks have two main options:

The lending industry faces many challenges, including changing regulations, increased demand, and disruptions in the financial markets. As a result, lenders seek to respond quickly to loan requests and provide the best possible service to their customers while minimizing risk. However, for traditional lenders, creating new products or adapting existing offerings can take months due to a monolithic IT system that is not very agile and not easily scalable.

To design agile and innovative financial products, implementing new solutions is becoming a priority for many lenders. Credit players are thus forced to consider maintaining their agility to remain competitive. They must be able to embrace a new modular approach. Core Banking Platforms technology allows them to integrate innovative products and technology partners to gain agility, responsiveness, and differentiation.

Financial players are not the only ones who need to innovate regarding the banking experience. E-commerce and corporate players are now looking to integrate comprehensive payment services to smooth the customer experience and meet new consumer demands.

The challenge here is to gain commercial agility while remaining compliant and profitable. These players need to be able to rely on a stable and available solution to avoid any disruption of service to their customers, which would result in a loss of revenue.

Financial and non-financial players must now take up the challenge of moving from "finance for all," which has been successful over the last fifty years, to "finance for everyone." This means developing specific financial services for each group and sub-group of the population to cover increasingly individual and personalized market needs. Faced with this demand, only the innovation of Core Banking Platforms seems relevant.

With Skaleet, you can orchestrate best-of-breed products and services through a documented API catalog. With a plug-and-play configuration, you can integrate the modules of your choice to customize your solution to meet new customer expectations and requirements. This approach radically overturns the rigid and historical paradigm of Core Banking Systems: by boosting the level of performance, scalability and launch new products to address markets, customers, and uses more quickly.

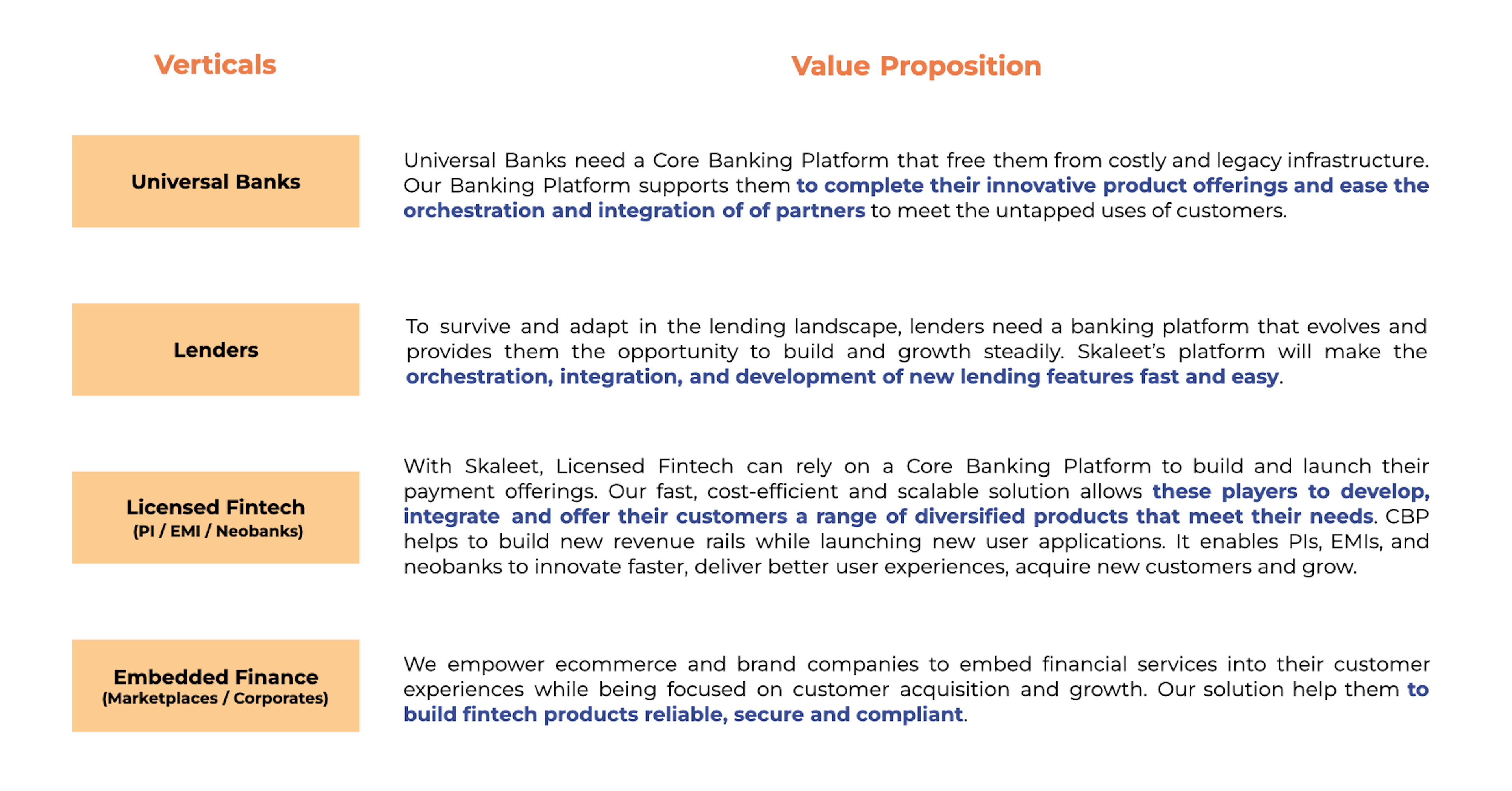

With its modular and flexible technology, Skaleet's Core Banking Platform helps every financial player meet the challenge of financial innovation:

So, become an architect of your business by building your innovation ecosystem with Skaleet: contact us!

Innovation. FinTech. Digital Banking. Neobanks. Open Banking. Core Banking. Cloud.

March 16, 2023

In an ever-changing payment market, financial players face...

Register to our newsletter