March 29, 2022

DORA: The New Banking Resilience Challenge! 💪

The DORA regulation thus represents an opportunity for banks to reinvent themselves with a clear objective.

The PaaS (Payment-as-a-Service) model allows banks and other financial institutions to offer their customers advanced payment products and services without resource-laden internal development investment costs. PaaS providers enable banks and other organizations to move to a more flexible, agile model – offering optimal products through one or more cloud-based third-party platforms. But for the PaaS model to realize its full potential, customers and their platform providers need to reconsider their operating models.

The following can lead to the successful implementation of PaaS:

The payment sector has been severely disrupted by non-banks like large technology companies, retailers, fintechs, and even telecommunications providers specializing in niche, value-added payment processing services. Outsourcing as a business strategy has grown in popularity in this hyper-competitive industry.

Traditionally, banks outsource non-core functions like data management, hardware and software, risk management, support services, ATM activities, and third-party service providers. ATMs are a classic example of a service that is outsourced to a service provider; the ATM equipment belongs to the service provider but cash management and the network remain in the hands of the bank. Several of the main banks have used this outsourcing model to broaden their ATM network.

Non-banks specializing in value-added services in the payment ecosystem represent a paradigm shift in the payment industry. By offering payment service products with no large upfront investment, this new generation enables financial institutions and other non-banks to grow and meet customer expectations. Businesses are able to outsource their payment products. Not only are financial institutions outsourcing non-core functions, but also core functions such as transaction management, payment processing, KYC and AML management, technology management, and cybersecurity. The practice of outsourcing these components of the payment value chain is referred to as "Payments-as-a-Service" (PaaS). PaaS for payments can be thought of as a hybrid of Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS).

PaaS providers have emerged on the market over the last two years, offering financial institutions specialized services such as payment engine hosting, reconciliation and settlement, cross-border payments, and third-party collections via a cloud platform. Additionally, these providers assist banks in addressing their growing concerns about security and fraud following the regulatory changes and by decreasing the payment infrastructure costs by 60 to 70%.

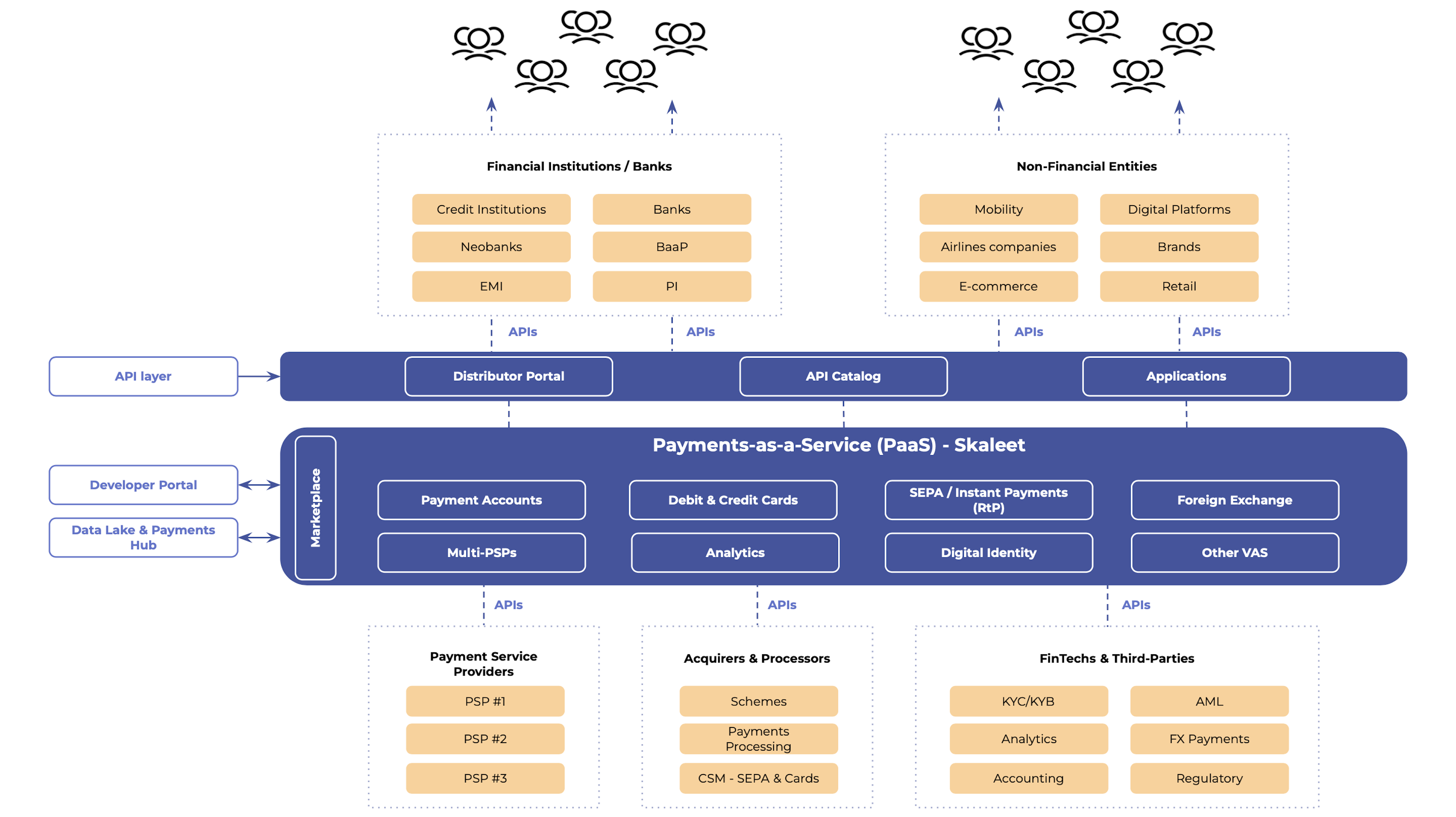

Today, PaaS offerings on cloud-based platforms span the entire payment value chain. Service providers can collaborate with banks, fintechs, insurers, telecommunications companies, and e-commerce businesses, among others. All of these are capable of integrating their solutions with PaaS platforms via Open APIs, depending on their business requirements. PaaS offerings are typically scalable with high availability; they accelerate service commercialization and provide a cost-benefit to customers.

The payment ecosystem is undergoing a seismic shift. New trends and innovations are putting acute pressure on organizations to satisfy consumer demands. Security is of vital importance due to the growing threat of fraud and criminal activity. The industry needs to act on five main issues:

Consequently, there are two options for banks to consider: (1) manage customers and transactions themselves and outsource payment functions to third-party service providers; (2) partner with fintechs – allowing them to manage distribution and customers – with banks retaining ownership and distribution of product offers (BaaS business model). Updating and transforming Core IT systems to become a market trailblazer and observing regulatory standards takes time and initial investment, which impacts margins. This makes outsourcing payment functions a good choice for financial institutions.

As a platform, PaaS offers multiple benefits to banks, financial institutions, and other organizations across the whole payment value chain. The main advantages of PaaS include:

Payment service providers built on new technology offer their operational functions to financial institutions and non-banks. Payment service providers use a Core Banking Platform that they can network with legacy systems and new generation systems via an API-driven approach. Hosted in the cloud, these platforms are networked with the payment network, operating systems, databases, and toolkits for development. Their offerings split into two approaches: product technology implementation and day-to-day operations.

A) Technology implementation services

Issuing switch: This module is responsible for the core functionality of an end-to-end application service, from customer onboarding to transaction processing. It enables the reflection and completion of online and offline transactions. It is capable of performing end-to-end transactions, from alerts to currency exchange in financial transactions, along with real-time processing and settlement. For instance, a financial institution can offer payment cards to transport operators (tube, bus, etc.) via PaaS. These payment cards can be used and accepted as tickets at multiple touchpoints.

Acquiring switch/app: This module assists financial institutions and other entities in acquiring merchants/aggregators. There are two possible models: the live merchant and an aggregator to whom the financial institution offers the payment product. The merchant will be integrated into the switch with the fewest possible contact points and the highest possible value. Once integrated, the switch interface will provide a credential/token for the retailer to share with the financial institution in order to integrate their API/SDK. For instance, financial institutions provide a QR code to all merchant types through a payment service provider-hosted acquiring switch.

Enhancing and implementing new regulations: Service providers will develop the necessary solutions and meet new requirements relating to regulatory enhancements or new directives.

B) Payment operations and product support

Reconciliation and settlement: As a general rule, three-way reconciliation services (switch, Core Banking, and card network) are offered by payment service providers to financial institutions and non-banks.

Managing disputes: The dispute management model helps businesses manage all disputes using business rules. The module helps guarantee seamless recovery for merchants, reconciliation, and risk management.

Transaction monitoring: Revealing and handling bugs/problems - the support team supplies services to resolve problems in a production environment.

Acquisition support for merchants: A module allowing acquirers to manage their processes to facilitate payment acceptance for merchants. The services involved in this module comprise merchant onboarding, settlement of transactions, fraud management, dashboard reports, and reconciliation.

Customer complaint management: A module that handles customer complaints and updates customers with SMS/email alerts once a ticket has been resolved.

Analysis and statistics: A module that allows financial institutions to run daily, monthly, or annual reports as well as trends and highlights.

User management and security: A module allowing entities to manage user access as per their roles and authorizations for different activities.

C) PaaS pricing structure

PaaS pricing structures vary according to the type of product offering and customer needs. The main pricing models are as follows:

One-off implementation costs: Ad hoc implementation costs include the personalization of the platform to respond to customers’ business needs. It can also include the cost of User Acceptance Testing (UAT,) the Core Banking Platform, and the transfer cost that the bank has to pay the PaaS provider. The license cost is invisible to the final consumer, being paid directly to the PaaS provider and shared between the financial institutions (service beneficiaries). Consequently, the total implementation cost with a PaaS model is lower than that of a legacy model.

Pay-per-Use costs: Some PaaS offers are invoiced per transaction. This model is the most commonly used by PaaS organizations. However, there is a minimum commercial commitment that has to be agreed on at the point of subscription.

Monthly/annual maintenance costs: This mostly involves the cost of maintaining applications and the cost of allocating hardware which is decided on depending on the needs of the organization.

As innovations in payments and financial technologies continue to develop, there will be more startups focused on the future entering the market to supply external services in the payment chain. It looks likely that PaaS will continue – and even accelerate – the rapid pace of change and innovation in the payments world.

Innovation. FinTech. Digital Banking. Neobanks. Open Banking. Core Banking. Cloud.

March 29, 2022

The DORA regulation thus represents an opportunity for banks to reinvent themselves with a clear objective.

Register to our newsletter