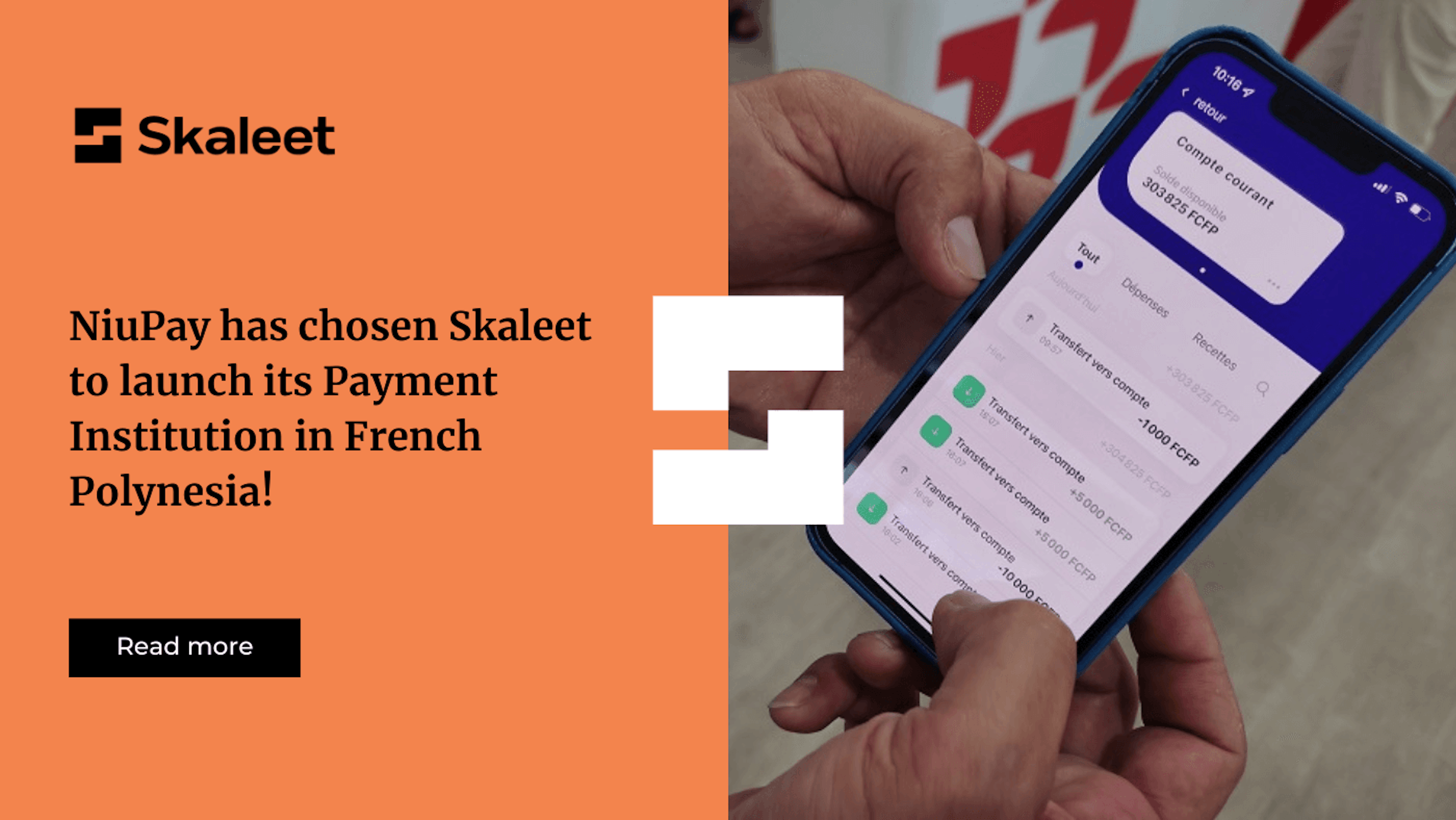

November 22, 2022

French Polynesia is an ideal innovation laboratory for developing technologies tailored to our needs. We are delighted to contribute to our region's financial inclusion through a concrete and equitable island solution that reduces disparities among local populations and, finally, allows us to serve the payment needs of all Polynesians who continue to face difficulties in accessing daily financial services.

It is important for us to partner with financial institutions that share our vision and ambition to innovate and adapt to change. We are delighted to contribute at our level to the development of a future-oriented solution that contributes to Polynesians' financial inclusion through this technological partnership with NiuPay.

Can we email you?