April 21, 2022

Evolution of card-based and A2A payment processing! 💳

The payments industry is preparing itself for a "cardless" world.

Faster, cheaper, more transparent, and more inclusive, New cross-border payment services offer solutions that benefit citizens and economies all over the world.

Cross-border payments are financial transactions where the payee and the recipient are located in different countries. The term covers both wholesale and retail and includes remittances. Cross-border payments can be carried out in different ways. Bank transfers, credit card payments and alternative payment methods like electronic wallets and mobile payments are currently the most widespread ways of transferring money across the world.

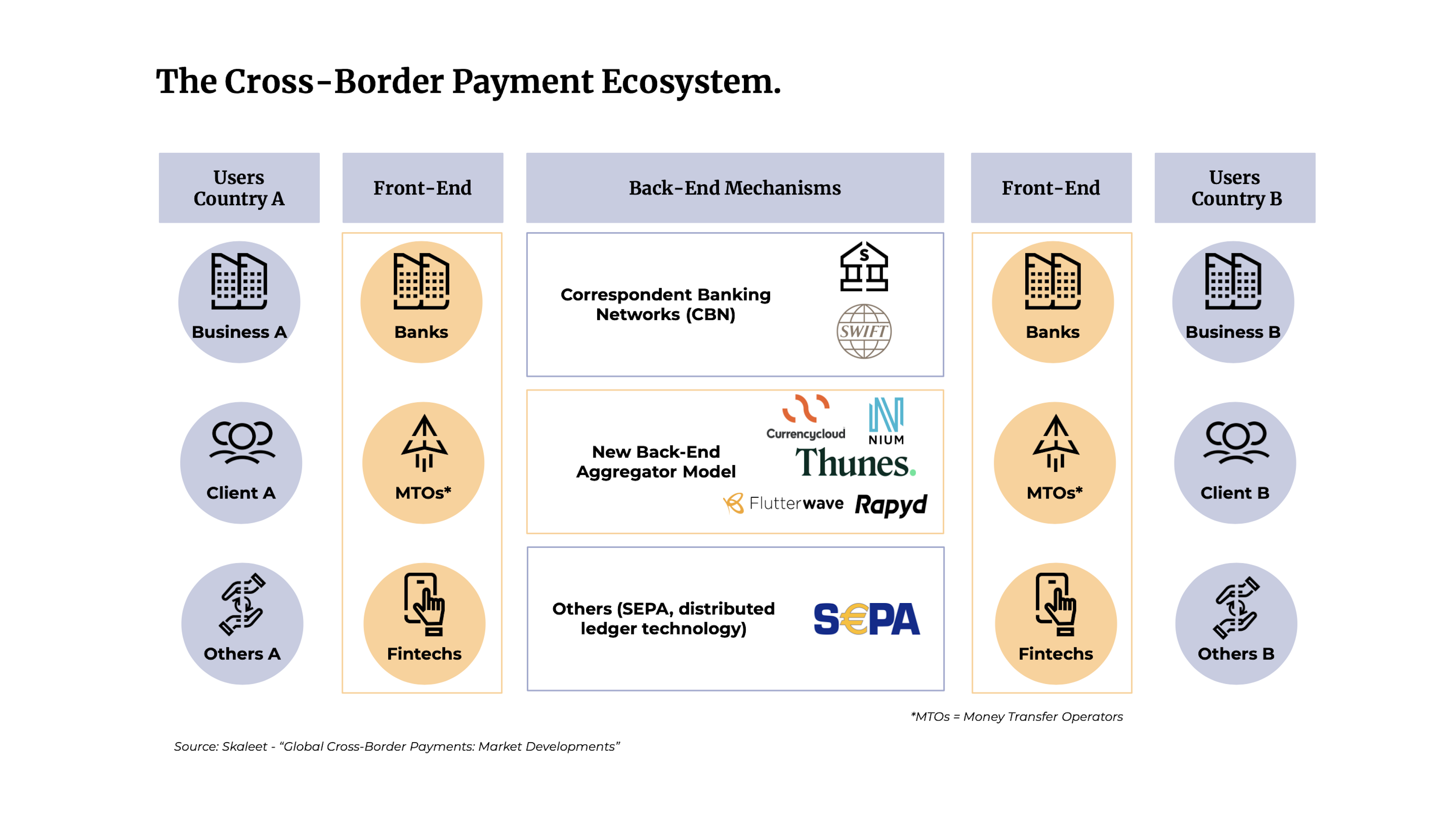

A payee will generally opt for a known provider, like a bank or a money transfer service like Western Union or Wise to initiate the payment. The payee informs the recipient of the payment medium. Traditionally, cross-border payments are sent via networks called Correspondent Banking Network (CBN) that most suppliers use to make payments. In the last few years, new back-end networks have emerged that enable optimized cross-border payments and the creation of interoperability between different payment methods, and that open up possibilities for payees to send funds.

From an operational point of view, funds function in ‘closed-loop’ systems. Domestic payment systems are not traditionally directly connected to other countries’ systems, so during a transfer between two entities, the currency is not physically transferred overseas. Rather, international banks provide accounts to their foreign counterparts to carry out foreign currency payments. Funds do not cross borders. Instead accounts are credited in one jurisdiction and debited for a corresponding amount in another. Other payment providers like money transfer agents and fintechs are increasingly approaching new back-end networks to speed up the flow of funds for both businesses and individuals.

There are currently two types of cross-border payments:

During the last few decades, the increased international mobility of goods, services, capital and people has contributed to the growing economic importance of cross-border payments. According to the Bank of England, value of cross-border payments could be over 250 trillion dollars by 2027.

Historically banks have been at the center of the cross-border payment market. However, end consumers and businesses have encountered various problems, like a lack of transparency, long settlement periods, high transaction costs and limited accessibility on the banks’ part. This means a transaction from a French bank account to Senegal could incur more than €100 of charges depending on the transaction value, and could take up to seven days to be settled. And sometimes, the sender does not even receive an acknowledgment that the transaction has been completed.

These conditions are ripe for competition and new players have entered the market to allow end consumers to have access to efficient, reliable cross-border payment services. The landscape has become more fragmented and competitive as companies focus on different geographic zones, different transaction sizes and different payment segments.

Although many new entrants aim to change the underlying nature and dynamic of the entire cross-border payment market, most are focusing on low-value transactions in the C2C, B2C and B2B segments. These segments are currently underserved by the banks and traditional service providers. These low-value transactions from, to, and between emerging markets have the highest disruption potential driven by consumer behavior, increased trading with emerging markets, and the need for greater financial inclusion.

Cross-border payments lag domestic payments in terms of cost, speed access, and transparency. It is generally more difficult to carry out a payment from one country to another than to make a similar payment within a single country. In some cases, a cross-border payment can take several days and cost 10x more than a domestic payment.

Improving cross-border payments is needed as there are currently many frictions:

Payments are made via messages sent between financial institutions to update the accounts of the sender and the payee. These payment messages must contain sufficient information to confirm the parties’ identities and the legitimacy of the payment. recipient. Data standards and formats vary considerably by jurisdiction, system, and messaging networks. This makes it difficult to implement automated processing, leading to processing delays and an increase in technology and personnel costs.

The unequal updating of regulatory screening systems for sanctions and financial crime can make it necessary to check the same transaction several times to verify that the parties are not exposing themselves to illegal finance. This makes compliance checks more costly to design, hampers automation, and leads to payments being delayed or rejected.

Bank account balances can only be updated while the underlying settlement system is available. Even when there are extended operating hours it often only occurs for specific, critical payments. This creates delays in clearing and settlement of cross-border payments, in particular when there are significant time-zone differences. This leads to delays and means banks need to hold sufficient cash to cover the unknown, fluctuating cost, making the overall cost of the transaction greater. This is knowns as trapped liquidity.

A large part of the technology handling cross-border payment systems is based on legacy technology built when paper payment processes were being migrated for the first time to electronic systems. These legacy technologies have fundamental limitations, like the need to process in batches, a lack of real-time monitoring, and low data processing capacity. This requirement to interface with legacy technology can be an obstacle to the emergence of new business models and new generation technologies.

For rapid settlement, banks have to provide funding in advance, often in several currencies, or have access to foreign currency markets. This creates risks for the banks for which they have to put aside capital to cover; so the capital cannot be used for other business activities. Uncertainty in terms of the moment the entrance funds are received often leads to an overfunding of positions which increases costs.

These frictions make it expensive for banks to have relationships in each jurisdiction. This is why the Correspondent Banking Network (CBN) model is used, but that leads to longer transaction chains, increasing costs and delays, creating the need for extra financing (including to cover unpredictable costs deducted along the chain), repeated validation, and the possibility that the data can be corrupted at any point on the chain.

Why have improvements to cross-border payments been slower to materialize than for domestic payments?

Cross-border payments are, by definition, more complex than domestic payments They involve many intermediaries, time zones, jurisdictions, and regulations. However, there are other frictions: capital controls, demands for documentation, compliance processes, etc. The multidimensional nature of these challenges shows that international collaboration is necessary to improve cross-border payments.

International transactions are booming. Consumer behavior has been fundamentally altered by the pandemic, digital payments are now entrenched in all regions and across all demographics on an unimaginable scale. They are expected to reach 156 trillion dollars by 2022!

Several trends will shape cross-border payments in the next few years:

Consumers are used to using applications that offer a quick, transparent, and interactive experience. The stage between the final choice and payment is often the most stressful – indecision can lead to a purchase being abandoned. Fintechs, marketplaces, and other software providers will continue to integrate payments into the purchasing experience. Alternative Payment Methods (APMs) like Buy Now Pay Later (BNPL) and Instant Payment offer consumers the ultimate freedom and flexibility to buy without knowingly making a payment. Payment will become less and less visible.

During the pandemic, although the physical world came to a standstill, artists and content and media creators joined influencers and other creators on social media in a virtually connected world without borders. They unleashed a vast, booming creator economy. Crunchbase estimates that 50 million people across the world think of themselves as creators, maintaining that influence marketing is about to pass 3 billion dollars. With the introduction of biometric payments and alternative payment methods, it is however possible to create a transparent user experience. However, low-value transactions remain expensive with many frictions. New services and platforms like Patreon and Cameo enable creators to collect payments more easily but there is still a lot to do. This space will continue to grow gradually and new innovative models and new entrants will emerge.

Although the global economy is becoming more interconnected, the contribution of small and medium businesses continues to increase considerably. SMEs and micro-businesses are the backbone of the global supply chain but they have less access to financing and participation in international payments than large businesses. Even today, the last leg of the payment journey is prone to inconsistency, because of politics, and differences in regulations and infrastructure between one country and another. In emerging economies where most of the population does not have a bank account, the final stage of payment delivery generates extra costs and delays. To create more cross-border interoperability between different local payment networks the new back-end players will continue to design new capacities to support an inclusive financial environment.

Unfortunately, online fraud increases in tandem with the rise of the digital economy and the adoption of digital payments. Mastercard’s last survey on cybercrime indicates an increase of 49% last year. This systemic risk for the digital economy will continue to attract the attention of regulators and financial crime prevention authorities. With the use of biometrics, greater trust in digital identities, and compulsory identification of customers via secure 3D protocols, other forms of two-step authentication (2FA) must develop toward a seamless user experience. The mature use of AI in fraud detection and money laundering prevention will continue to increase straight-through processing and reduce cross-border transaction costs.

The global volume of cryptocurrency increased by 32% in 2021 according to the cryptocurrency exchange platform Coinbase. The adoption of cryptocurrency is expected to accelerate with the emergence of the metaverse and Web 3.0.

Fiat currency continues to dominate in the mainstream. But the highly regulated Fiat-to-Crypto access and exit infrastructure will continue to develop. In time cryptocurrencies, on blockchain technology rails, will likely become a preferred payment method, allowing instantaneous real-time settlement and secure transactions on the digital market.

These trends and problems related to cross-border payments – delays, high costs, and lack of transparency – have led to the arrival of two specialist groups: digital money transfer operators and new back-end networks.

These deal directly with senders – consumers or merchants – and offer cross-border payments as their main business. When they work with cash currencies (eg. USD or EUR), these suppliers usually establish direct banking relations in the sending and receiving country, with circular payment flows between the countries. However, opening a bank account can be difficult in many emerging markets and capital controls often hinder the exiting of payments. Financial inclusion in these countries also tends to be lower with very fragmented payment methods. Under these conditions, digital money transfer operators often rely on partners like back-end networks in these countries.

As a general rule, these do not have direct relations with the sender or the recipient but deal with banks, neobanks, money transfer operators, fintech, and wallets. By setting up partnership networks via direct connections with local banks and APMs on the liquid/illiquid markets, back-end networks facilitate interoperability in cross-border payments. For example, a PayPal account can deposit euros into an M-PESA account in Kenyan schilling. As this is not possible with correspondent banking networks (CBN), front-end suppliers increasingly use these alternative back-end networks over traditional banking rails.

The extensive fragmentation of the global payment market and the various regulatory requirements mean that back-end networks generally focus on a certain set of countries or regions. Consequently, a sending partner, like an MTO (Money Transfer Operator) will have to connect to several main networks to offer a truly global solution to its clients.

The main networks generally use an aggregation model. Aggregation models reduce costs as most cross-border charges are incurred as fixed costs per transaction. Also, to confirm payments in real time, back-end suppliers usually request the prefinancing of the sending partners as a guarantee. This prefinancing by the sending partner allows back-end suppliers to credit the recipient’s account in real time once the transaction has been initiated.

The aggregator business model is most used for C2C, C2B, and B2C transactions which are usually low in value. Back-end networks can make these payments more quickly, more cheaply, and with more transparency than those made via CBN. For the moment these models are less successful in the B2B sector where average transaction values are often above $50,000. Guaranteeing the ability to prefinance values as high as this means senders have to considerably increase their working capital requirements. Also, these models offer less potential to reduce costs as the current unit economics of B2B transactions are better, due to higher average values and fixed costs. For these reasons, almost all high-valueB2B cross-border payments are still handled by CBN.

So, the cross-border landscape is becoming increasingly fragmented and competitive with new emerging technologies looking to resolve problems around delays, high costs, and a lack of transparency.

These new trends in the huge cross-border payment market offer opportunities along the length of the value chain, which will eventually include new partnership and acquisition strategies that will facilitate the creation of new infrastructures on a global scale. Following the partnership with Thunes, Skaleet is offering a SaaS banking platform that will enable the creation of financial institutions and payment establishments able to transfer money around the world. This new solution, integrated into the technology platform, allows any end consumer with a bank account to track a payment until it reaches the beneficiary and to check details in advance. The Best-of-Breed partnership will accelerate time-to-market, reduce costs and provide access to one of the most modern money transfer technologies. The common goal of these organizations is to allow their clients to disrupt their respective markets with innovative financial services.

Innovation. FinTech. Digital Banking. Neobanks. Open Banking. Core Banking. Cloud.

April 21, 2022

The payments industry is preparing itself for a "cardless" world.

Register to our newsletter