December 21, 2021

Why APIs are essential for the rise of Embedded Finance 🚀

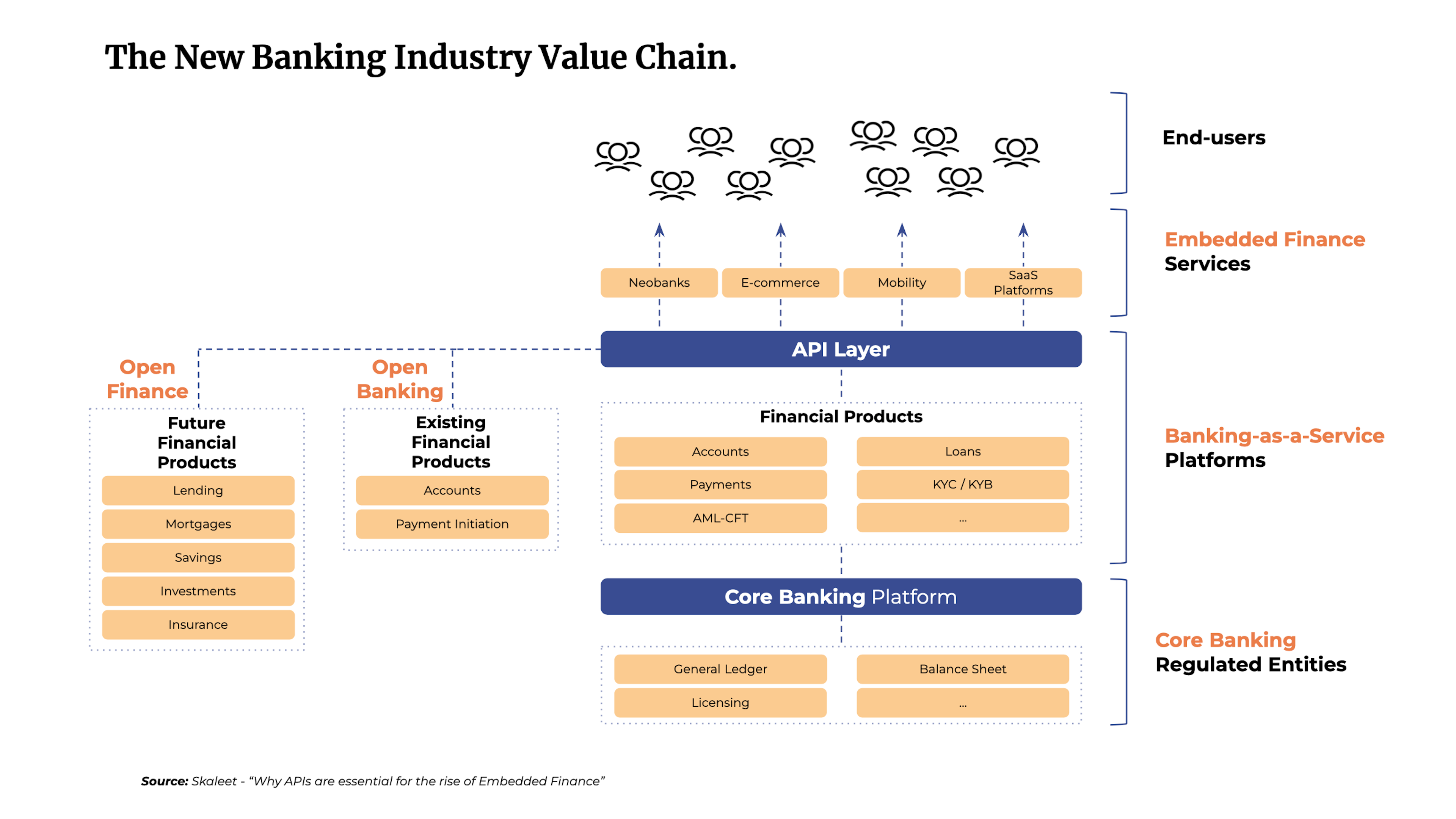

APIs have released a new wave of innovation in financial services, particularly across four main banking sectors.

"BaaS" is an acronym increasingly used in the financial sector. But what exactly is it? What is Banking as a Service? What opportunities does it offer to banks? What technical constraints does it create? All the answers are in this article!

Banking as a Service, or BaaS, is a business model that allows any company to offer banking services to its customers without obtaining a banking license or developing a financial infrastructure. How? By partnering with a bank or financial institution with a Credit, Electronic Money, or Payment Institution license. This partnership allows the non-banking company to offer white-label financial services: debit cards, payment services, and loans...

With BaaS, banks and financial institutions take on a new role: B2B distributor of financial services to unregulated third parties.

Read also: Banking as a service, platform, open banking, cloud banking... The big lexicon of finance 4.0

To better understand what BaaS is, let's use a concrete example.

A fintech wants to launch a neobank based on a mobile application dedicated to 15-25-year-olds. The fintech uses the services of a Bank as a Service to offer its customers an account with a debit card. It, therefore, relies on a bank to provide regulated banking services for its project and can focus on developing its mobile application.

This application communicates with the bank's IT system via APIs and Webhooks. The fintech does not directly manage its customers' accounts and money; the partner bank does. This delegation allows the fintech to save considerable time. It can be registered as a BaaS agent in a few weeks, whereas obtaining its registration would have taken 6 and 12 months.

Sometimes confused, Open Banking and Banking as a Service refers to two different models.

Having become mandatory in January 2018, Open Banking consists of opening banks' information systems. Customer data can thus be shared with third parties and financial service providers.

This model promotes collaboration between banks and new partners. This is how the fintech in our example can connect to the bank's feeds to offer banking services to its customers.

In short, Open Banking has paved the way for BaaS: the bank now can offer third parties the possibility of integrating banking products on their platform or application.

With Banking-as-a-Service, banks can multiply distribution channels and increase the market reach of their products. BaaS also allows them to address new customers, sometimes even new customer segments, from their partners' markets. In particular, the fintech in our example enables the bank to reach 15-25-year-olds with an innovative mobile experience, albeit in a white-label mode. This model then accelerates opportunities, giving the bank access to new customers.

BaaS also allows banks to face the emergence of fintech by positioning themselves as their partners rather than their competitors. Indeed, the neobank, in our example, could have undertaken an accreditation process with the ACPR to become a regulated financial institution. In this case, the fintech would have competed with the bank for offers for 15-25-year-olds. With BaaS, on the other hand, the neobank is leaning on the bank to save time and benefit from its expertise: it is not stealing market share.

Finally, the Bank-as-a-Service model allows financial institutions to multiply their direct revenue sources. Non-banking companies that rely on banks to provide financial services become customers of their partner banks. They pay the bank for the use of its APIs.

Read also: New business models for a new banking environment

Technologically, BaaS is based on the cloud and APIs (Application Programming Interfaces). This is how the non-banking company can connect to the bank and offer financial services to its customers. This requires the bank to adapt its IT strategy to enable this connectivity. Several business areas need to be studied to determine the technical implications of BaaS:

For more details on these 4 axes, please read our article: Open Banking: the technological challenges (Traditional IT vs. Open IT)

Because it is multi-dimensional, integrating APIs in a Bank-as-a-Service context can be complex. Fortunately, Core Banking Platforms offer open and modular solutions to make this easier.

The Core Banking Platforms allow for advanced management and monitoring of all the APIs integrated into the bank's IS via a single interface. Thus, the bank can:

This new management mode will allow more detailed management of the bank's APIs, with a clear view of each API. With this in mind, La Banque Postale called on Skaleet's Core Banking Platform.

Skaleet is a cloud-native solution enabling financial institutions to design, configure, and integrate new products and user experiences for B2C and B2B customers. Our solution enables banks to create Banking-as-a-Service players in an environment that meets the highest security standards. Expand your revenue streams with peace of mind! Want to know more? Contact us for more information!

Innovation. FinTech. Digital Banking. Neobanks. Open Banking. Core Banking. Cloud.

December 21, 2021

APIs have released a new wave of innovation in financial services, particularly across four main banking sectors.

Register to our newsletter